Working from home offers many benefits: from overhead cost-cutting to providing improved employee productivity and morale.

According to one study, 85 percent of businesses confirm that productivity has increased in their business because of greater flexibility. What's more, 63 percent of those surveyed report at least a 21 percent improvement in productivity because of flexible working.

This flexibility to work from home, not only makes workers happier (Owl Labs found full-time remote workers reported being happy in their jobs 22 percent more than workers who are never remote), but hopefully healthier. Recent events have added a new caveat: working from home reduces interpersonal contact, mitigating the spread of dire illnesses like the Coronavirus.

It should go as a surprise to no one then, that Software as a Service (SaaS), which allows for individuals to access their necessary software from any internet accessible location, is already a staple for many businesses and is expected to explode in usage.

As a show of unity, the 2020 Software as a Service Awards program announced it will donate part of its proceeds to the World Health Organization’s COVID-19 Solidarity Response Fund. "With the global rise of COVID-19, it's important that organizations worldwide consider the technology to let staff work from home,” said James Williams of the Cloud Awards. ”[It] is now an essential weapon in the fight to contain the virus …helping shield anyone with a 'desk job' from the risk this global pandemic represents.”

Past the current pandemic preparedness strategy, SaaS solutions provide tangible benefits for employees and organizations that move to the cloud. And these are no more evident than for mortgage lenders, community banks, and credit unions.

SaaS-based mortgage loan origination software (LOS) centralizes a mortgage lender’s system of record. By doing so, organizations with multiple locations in multiple cities and states can evenly distribute the workload of loan processors, mortgage underwriters, and any authorized user who touches the loan. The digital mortgage with e-signatures replaces the need (not requirement) for in-person meetings. The addition of a front-facing web-based point-of-sale (POS) gives that same flexibility to home buyers as well as a wealth of information they need to make informed decisions (such as). The end results? Happier borrowers, lower cost operations, faster closings and more closed loans.

Curious to hear how our lender clients are faring during the pandemic? Contact us for client testimonials who can provide their experiences. At OpenClose, we’re confident that we will get through this together. We believe soon things will be looking up. And so should you – to the cloud.

.jpg?width=8688&name=shutterstock_632956724%20(1).jpg)

According to

According to

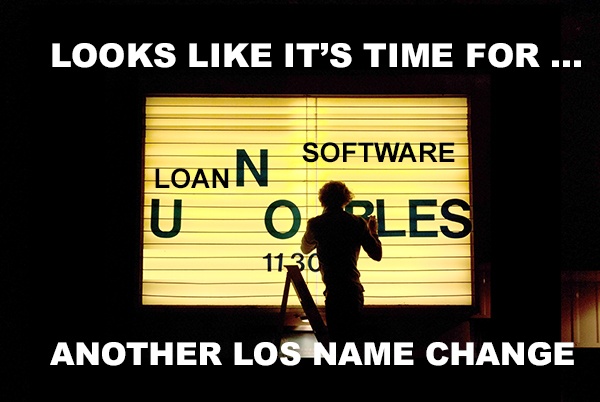

Recent LOS Acquisitions in Mortgage Loan Origination Software have left Lenders asking… Where Does This Leave Me as a Customer?

Recent LOS Acquisitions in Mortgage Loan Origination Software have left Lenders asking… Where Does This Leave Me as a Customer?